Please click here to be redirected to our Real Estate Search. You can search for your property by name, address, or parcel number. Your tentative value will be displayed at the bottom of the page under “Values”.

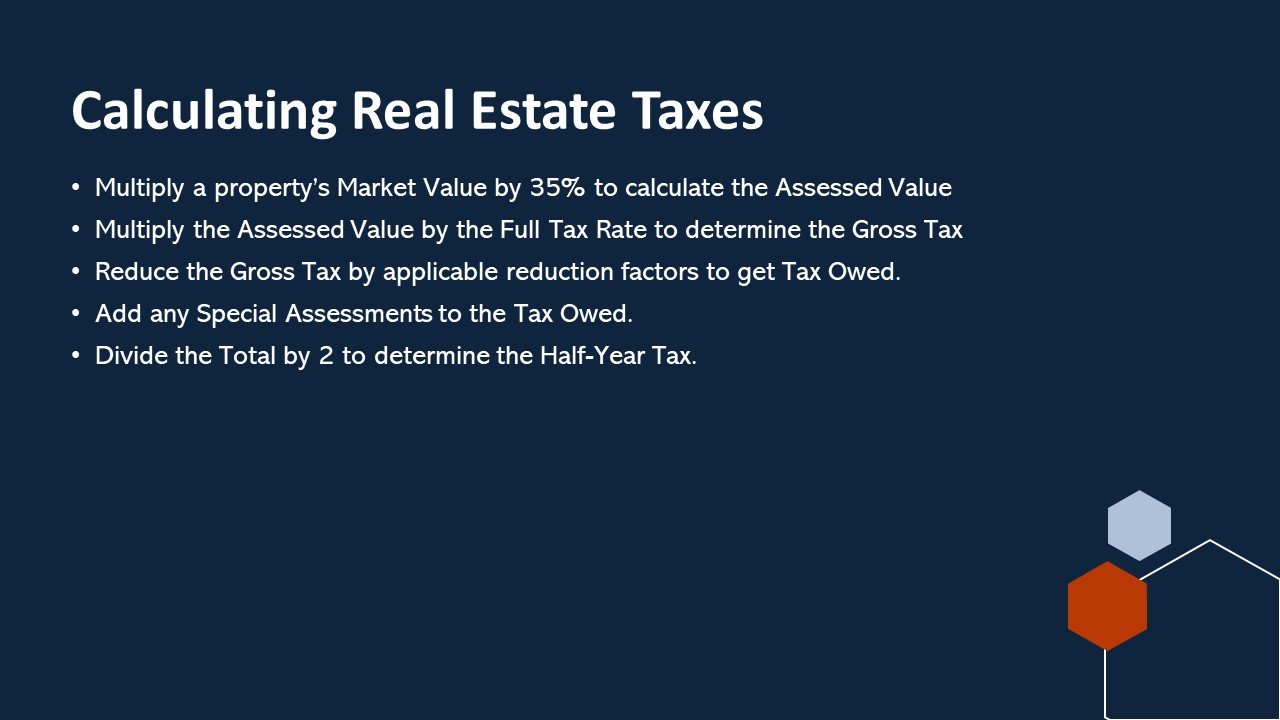

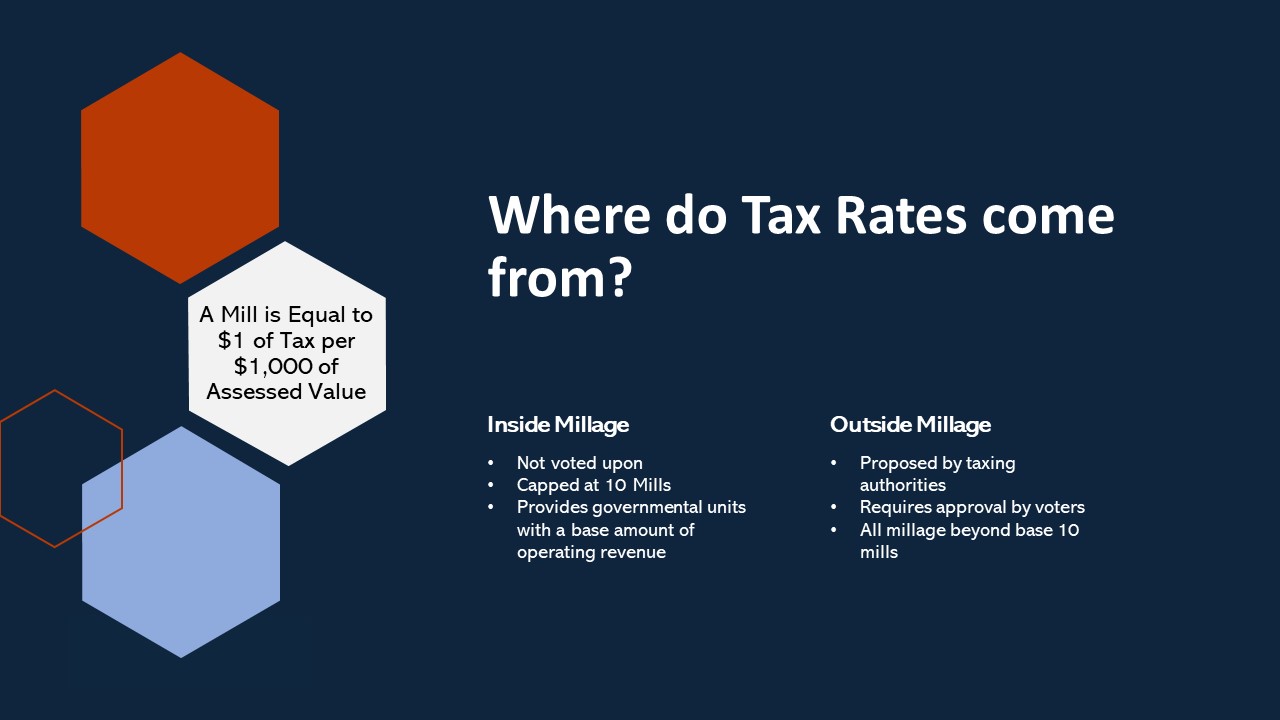

At this time, the Auditor’s Office is unable to provide you with your real estate tax amount for next year. This is because the tax rates will not be finalized by the State of Ohio until the end of December. If you call the office or visit the Auditor’s website in mid-January, you can obtain your actual tax amount. Until then, you can click here for a tax estimator that will provide an estimate of tax using your market value and this past year’s tax rates.

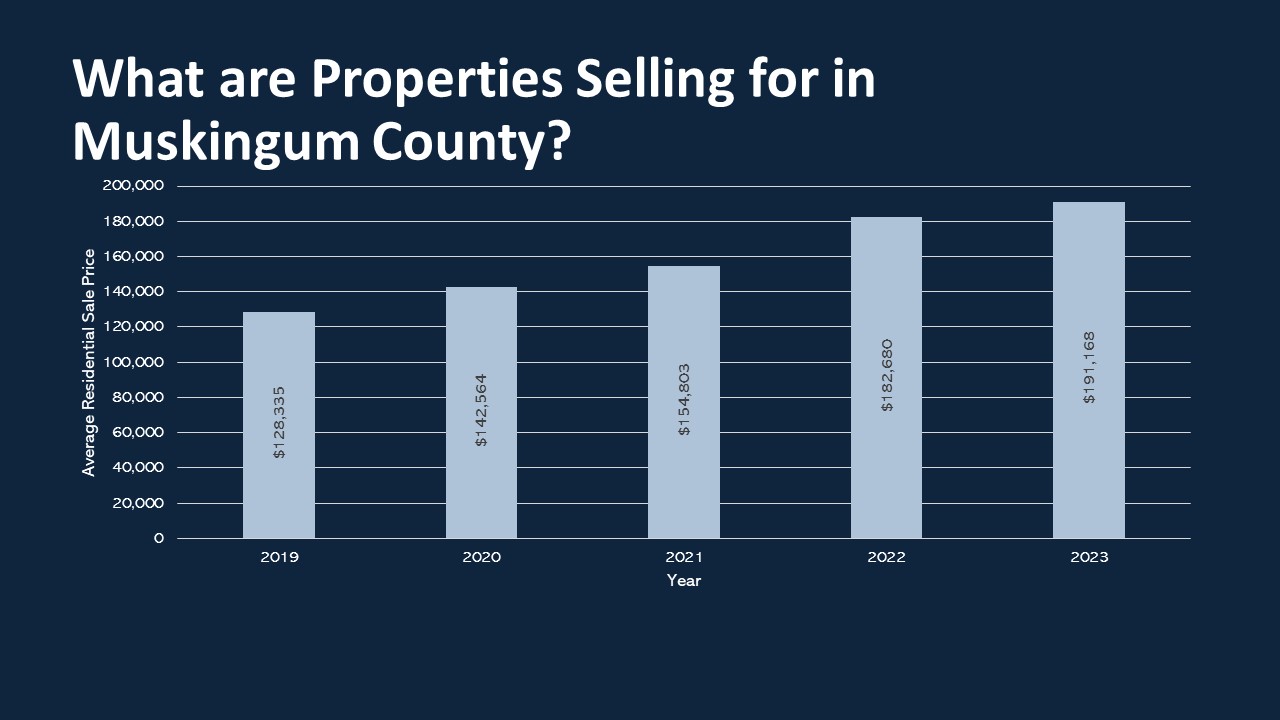

According to Ohio Revised Code, the County Auditor is required to revalue all properties in the county every six years. As part of this revaluation, sales over the past three years were reviewed to determine if properties were valued at or near what they would sell for. Due to purchase prices of properties trending upward, values were increased. The average value increase in Muskingum County was 36.135%.

Beginning January 1, 2025, you can file a Complaint Against the Value of your property. This will open a formal Board of Revision case that will review your property with the County Auditor, County Treasurer, and one of the County Commissioners. Complaints are accepted through March 31, 2024.

Evidence may include sale comparisons, recent (within the past year) independent fee appraisals, estimates of costs to repair deficiencies in your property, recent sale documentation (within the past year), income and expense statements, or photos. You may submit more or less information based upon your individual circumstances. If you will be having an Informal Review, you may submit your information in advance.

You can have an informal review of your property. If you are still unsatisfied following the review, you can file a Board of Revision case in the County Auditor’s Office between January 2nd and March 31st. A Board of Revision case is a formal complaint against the value of the property. Your case will be held before the County Auditor, County Treasurer, and one of the County Commissioners. Evidence in support of your case will be required. Click here for more information about the Board of Revision process.

Every six years, the County Auditor is required to revalue all property in the county. Recent sales are considered in this revaluation and sales prices have trended upward the past several years. The market value set by the Auditor’s Office should accurately reflect the amount you could expect to sell the property for. Click here for recent sales history.

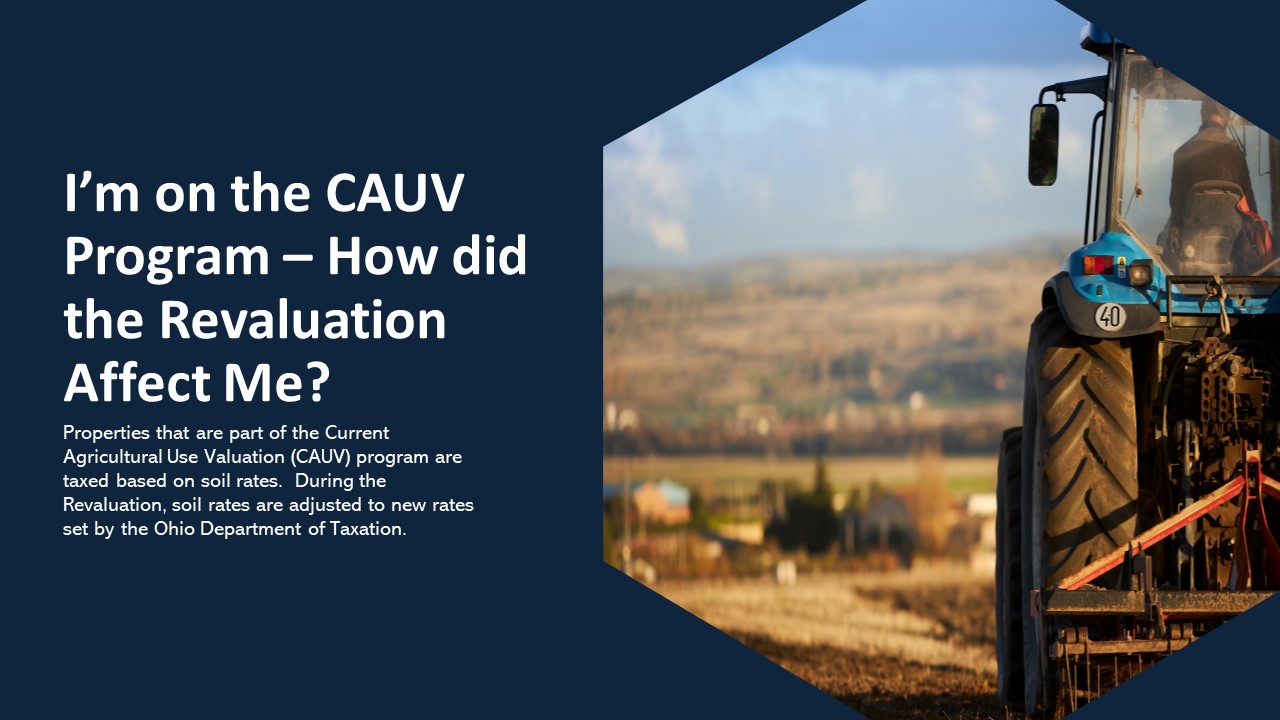

Acreage enrolled in the CAUV program is taxed based on the soil rates instead of the market rates. Soil rates are set by the Ohio Department of Taxation and updated every three years. The Department of Taxation sets the rates based on yield information, cropping patterns, crop prices, non-land production costs, and capitalization rates. The Auditor does not set soil rates.

The county is not raising property taxes to pay for the new county jail.

First, increases in value are not equal to increases in taxes. The county is required by state law to revalue property every six years. The last revaluation was in 2018 which means 2024 is the year set to revalue property.

Second, Real Estate Taxes are based on levies. The county has not put a levy for the jail on the ballot.

Yes, every employee of the Auditor’s Office had their property reviewed to ensure that values were raised across the board.

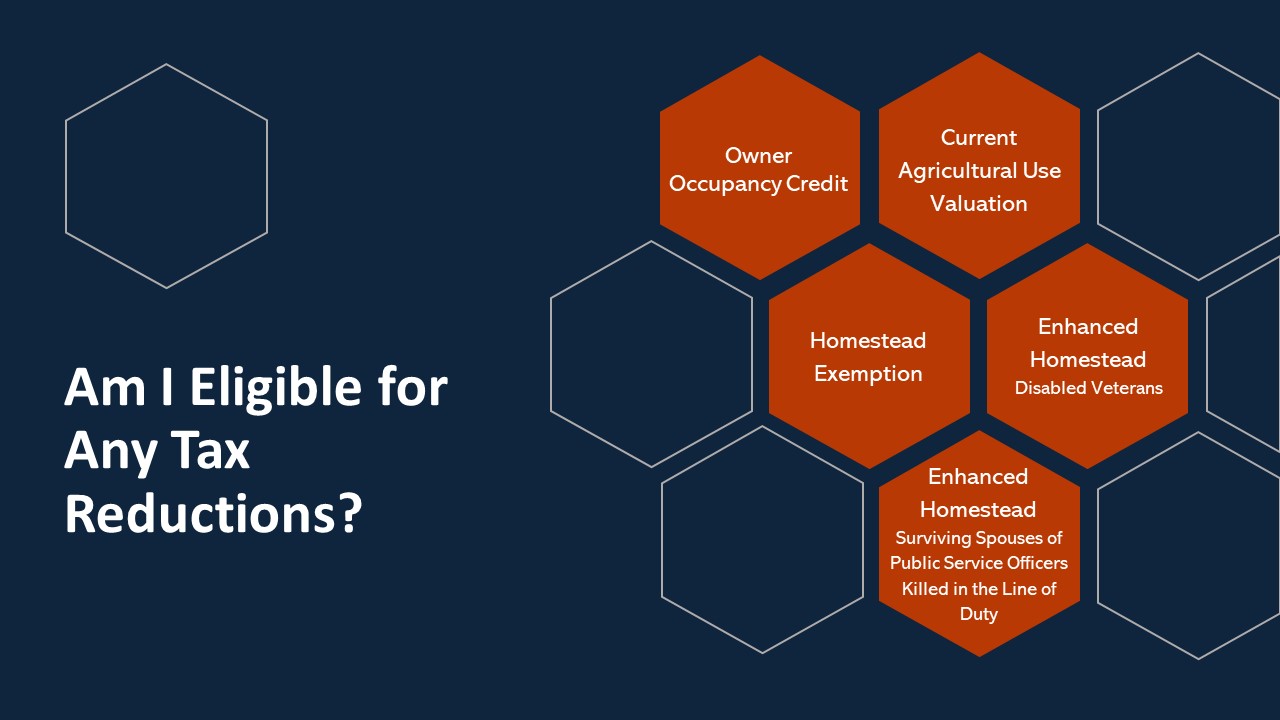

Absolutely not! Our office wants to ensure accuracy and equality across the board. We offer several tax savings programs that you may be eligible for – the Owner Occupancy Credit, Homestead Exemption, and Current Agricultural Use Valuation Program.

Your property will be certified delinquent and will be eligible for county foreclosure in two years. If you have difficulty paying your taxes, you can contact the County Treasurer’s Office to see if you would be eligible for a payment plan.

First half taxes will be due February 14, 2025 and second half taxes will be due June 13, 2025 per the Muskingum County Treasurer.

The Muskingum County Auditor's Office mailed value change letters in regard to the 2024 Revaluation in September 2024. At this time, the Informal Review period for these values has closed. Any value changes resulting from the Informal Review period will be reflected on this website on October 25, 2024. If you have any questions or concerns, please contact the Real Estate Department at (740) 455-7109, option 1.

If you should still have concerns regarding your property's value, you may file a formal Board of Revision case between January 1 and March 31, 2025. It is recommended to submit evidence for review at the time of filing. Evidence may include, but is not limited to:

Please click here to be redirected to our Board of Revision page with more information about this process.

How do I know if my property is Residential/Agricultural or if it is Commercial/Industrial?

You can click here to search for your property by name, address, or parcel number. On the left-hand side is a menu. Select "Tax Card". On the right-hand side of the tax card, you will see the taxpayer address, followed by the land use and the class. The class will state your property type.

Do I need to bring evidence to my informal review?

Evidence is not required; however, you may not see an adjustment to your property value without significant supporting documentation of your request.

How will I know if my property value was adjusted?

Property values will be finalized by October 25, 2024. Please check back here to see if your value had an adjustment.

Were sale values really higher than the previous market values that were used in the 2021 Tax Year?

Yes. You can view recent sales by clicking here.

For more Frequently Asked Questions about the 2024 Revaluation, please click here.